existing household real estate assets declined $67 Billion in the 3rd quarter. That’s about $200 for every man, woman, and child in the US.

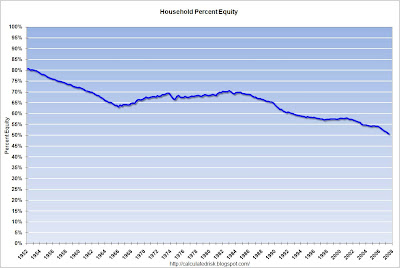

You can see this in declining home equity percentages over time (there are more graphs at the link):

While we’re at it, Morgan Stanley analysts are saying that home prices could be falling for at least the next three years.

.…

The property derivatives market seems to be suggesting that we are in a very different environment, on the heels of market events that could force a housing recession like none ever imagined or experienced,” Morgan Stanley analysts said.“The fundamental argument for going long housing is that history has never seen such extended periods of house price declines,” Morgan Stanley said. “We think that such arguments have limited credibility because of limited periods of data and over-reliance on analysis using national level data.”

While home price declines for three years or longer have not occurred in recent years on a national level, regional data demonstrates that unusual price increases often lead to sustained corrections, the report said.

….

And then we have Standard and Poors sayint that the mortgage relief program might cause downgrades on some of the related bonds.

Honestly though, I don’t see how the action will make things much worse:

.…

The share of all home loans with payments more than 30 days late, including prime and fixed-rate loans, rose to a seasonally adjusted 5.59 percent, the highest since 1986, according to a report today from the Washington-based bankers trade group. New foreclosures hit an all-time high for the second consecutive quarter in a survey that goes back to 1972.

….