Dealing with family obligations.

Year: 2012

Gee, What a Surprise, Regulation Encouraged Cell Phone Companies’ Investments

Last year, the government blocked the merger of AT&T and T-Mobile, and the free-market mousketeers said that it was going to kill private sector investment.

Well, not so much:

Last year, the regulatory agencies charged with overseeing the wireless communications market did something unusual: they actually regulated. After spending the Bush years eagerly facilitating the consolidation of the wireless market, in 2011 the FCC and the Justice Department blocked AT&T from merging with T-Mobile over fears that the deal would be anti-competitive and result in job losses. At the time, conservatives in the media decried this move as gross overregulation of a burgeoning market that would dampen investment and stifle technological development. But here we are almost one year out, and those dire prognostications haven’t played out. In fact, quite the opposite has happened.

………

So what’s happened since then? Well, when the AT&T/T-Mobile merger was first announced, T-Mobile’s parent company, Deutsche Telekom, was looking to wash its hands of the U.S. market. But after the merger fell through and AT&T was obligated to fork over $3 billion to T-Mobile along with a sizeable chunk of wireless spectrum, T-Mobile took the money and invested it almost immediately in network modernization. Now Deutsche Telekom — once eager to be done with the U.S. — is moving to acquire low-cost carrier Metro PCS to build out T-Mobile’s high-speed 4G LTE network.

Meanwhile, the Japanese telecommunications firm Softbank is snapping up Sprint Nextel and infusing $8 billion into the wireless carrier, which will be used to build out its own network. Back when people still thought the AT&T/T-Mobile merger was a sure thing, it was assumed that Sprint would have had to merge with Verizon and we’d be left with a wireless duopoly. Now both Sprint and T-Mobile are investing in their own networks and working to emerge as serious competitors.

And what of AT&T? When the company first announced the proposed merger with T-Mobile in March 2011, it made much of the fact that it would “increase AT&T’s infrastructure investment in the U.S. by more than $8 billion over seven years.” Three weeks ago, AT&T bumped up that number significantly, announcing that “it would invest an extra $14 billion to expand its wireless and broadband services over the next three years.” The New York Times reported on November 9 that the decision to boost infrastructure investment “was motivated by AT&T’s failed $39 billion takeover of T-Mobile USA.”

As a rule of thumb, if a free market absolutist says that something is white, bet on black.

This Will Never Make it to Obama’s Desk

While I am heartened that the senate has passed an amendment to the Defense Authorization bill to ban indefinite detention without trial of US citizens and green card holders:

The Senate voted late on Thursday to prohibit the government from imprisoning American citizens and green card holders apprehended in the United States in indefinite detention without trial.

While the move appeared to bolster protections for domestic civil liberties, it was opposed by an array of rights groups who claimed it implied that other types of people inside the United States could be placed in military detention, opening the door to using the military to perform police functions.

The measure was an amendment to this year’s National Defense Authorization Act, which is now pending on the Senate floor, and was sponsored by Senators Dianne Feinstein, Democrat of California, and Mike Lee, Republican of Utah. The Senate approved adding it to the bill by a vote of 67 to 29.

“What if something happens and you are of the wrong race in the wrong place at the wrong time and you are picked up and held without trial or charge in detention ad infinitum?” Ms. Feinstein said during the floor debate. “We want to clarify that that isn’t the case — that the law does not permit an American or a legal resident to be picked up and held without end, without charge or trial.”

The power of the government to imprison, without trial, Americans accused of ties to terrorism has been in dispute for a decade.

Even if Boehner were to support this, and my guess is that he won’t, I would expect the White House to fight this, on the theory that this is an executive branch prerogative.

What a Surprise. Management Lies About Labor

As you may, or may not be aware, the clerks at the ports of Los Angeles and Long Beach are on Strike.

The Los Angeles Times, in a reporting job that harkens back to their pre-Otis Chandler days, when they were the worst major daily in the nation, takes a claim by the management negotiator, and reports it as fact:

Stephen Berry, lead negotiator for the shipping lines and cargo terminals, said the clerical workers have been offered a deal that includes “absolute job security,” a raise that would take average annual pay to $195,000 from $165,000, 11 weeks’ paid vacation and a generous pension increase.

Of course, the idea that “clerks” get $165,000 a year, much less %195,000 a year.

Well, the slightly less credulous Long Beach Post, reports a slightly different number:

Employers however, feel most of these claims are highly questionable. They say that workers have rejected fair proposals in the last few years including the most recent one offered on Monday, the day before the walkout, which included: absolute guarantees that OCU workers will not be laid off; full-time pay for 52 weeks a year despite workload; permission to access computer database update histories and audit trails so as to allow clerical workers to research if anyone is using technology to divert their work; and most prominently, increase their compensation packages to over $190,000 in wages and benefits by 2016. Clerical workers currently make an average of $165,000 per year.

Well, if you assume about 10 hours of OT a week, normal in this environment, and that 30% of all remuneration is of the non wage form (healthcare, vacation, sick time, pensions), you get a base hourly rate of about $46/hour, which is nice, but not spectacular.

Also note that the union is demanding access to the job routing database, which indicates that there is a real suspicion that management is transferring jobs elsewhere.

Also, look how another source, from the same Stephen Berry, drops the pay number even further:

Stephen Berry, a negotiator for the employers, said under the old contracts, workers earn either $40 or $41 per hour, receive a full pension after as little as 10 years of work, and receive 11 weeks of paid time off annually.

Berry said the employers have offered slight raises. But both sides agree the dispute is not about money.

Union officials say the companies have been quietly moving some jobs to Taipei, Taiwan; Costa Rica; Charlotte, N.C.; and Texas, a charge employer representatives vehemently deny.

So,we are down to $40/hour.

But we are still relying on Stephen Berry, who is paid to lie for employers.

What if we found an independent source, something like an official government job posting, which lists the salary for a “Cargo Audit Clerk III- Provisional” as $16.69 – $22.80 Hourly.

Kevin Drum took the LA Times article as gospel, but his readers provided links (which I am using here) which show that both the Times, as well as Mr. Berry, to be full of crap.

Deep Thought

A Lesson in Economic Statistics from the Shrill One

Paul Krugman explains why Italian productivity has fallen precipitously over the past decade or so:

Paul Krugman explains why Italian productivity has fallen precipitously over the past decade or so:

Dean Baker, in correspondence, makes an interesting point about the mysterious productivity collapse in Italy — namely, that a big chunk of it could be a statistical illusion. This is always something you should consider when you see something strange in economic data.

Here’s the story: Italy, with its combination of extensive regulations and weak enforcement, used to have a lot of “black labor” — workers who weren’t on the books, so as to evade various government-imposed requirements. But then came reforms that made keeping part-time workers, etc., on the books less onerous — and the hidden labor came into the open. Measured GDP wasn’t affected, because statisticians were already making imputations for the shadow economy; so the result was a decline in measured productivity.

It’s a reasonable explanation. It’s not like Italy has stopped being Italy since 1995.

Entering the Euro zone has brought changes, but nothing that would have their actual productivity dropping off a cliff like this graph pr0n.

I Don’t Know Whether to Feel Schadenfreude, or to be Appalled

I’m not q big fan the USPTO’s tendency to grant a patent to everything these days, and I’m even less of a fan of Apples use of its patent portfolio as an alternative new ideas, but the folks at Cuppertino just got hit with a completely bogus patent claim:

I’m not q big fan the USPTO’s tendency to grant a patent to everything these days, and I’m even less of a fan of Apples use of its patent portfolio as an alternative new ideas, but the folks at Cuppertino just got hit with a completely bogus patent claim:

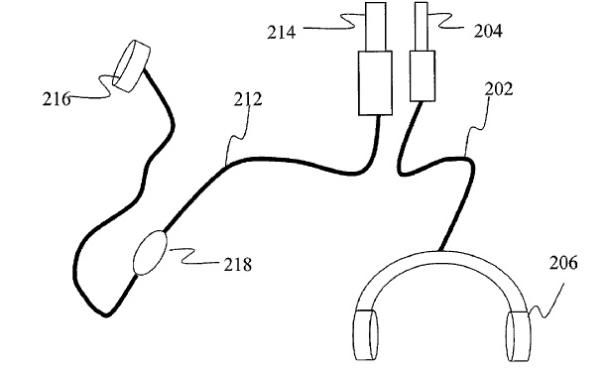

An apparent shell company has filed a $3 million patent infringement lawsuit against Apple for including headphones with its iPhones.

A company called Intelligent Smart Phones Concepts sued Apple last week in U.S. District Court for the Northern District of California, alleging that Apple infringed on U.S. Patent No. 7,373,182. The abstract for “Wireless Mobile Phone Including a Headset” describes an interface that allows a removable headset “to receive at least telephony audio signals from the phone, and to provide audio signals to the phone.”

Seriously, keep patent examiners away from toilet paper, because they will sign off on anything.

EU to Spanish Consumers Defrauded by Banks: Drop Dead

So Spanish banks lied to their customers, selling them preferred shares and telling them that they were government insured accounts, and now the EU is requiring that they get wiped out as part of a bailout:

Yves here. We’ve flagged in earlier posts how the Spanish banking crisis had the potential to become destabilizing politically, as if Spain wasn’t already at considerable risk of upheaval. Spanish depositors were pushed to convert their deposits into preference shares, which they were told were just as safe. That of course was never true.

This was a simple desperation move by the banks to save their own skins, customers be damned, by raising equity from the most unsophisticated source to which they had access. And now that that gambit failed, these shareholders are due to have those investments wiped out unless the Spanish authorities can cut a deal to spare them. The conditions of a bank rescue, which Spain did try to resist, was to have equity holders wiped out, or at least haircut. And that plan is now about to be set in motion. Having losses imposed on small savers who were in many cases conned by their own bank to buy these preference shares is going to do serious harm as well as further delegitimate the government.

Remember that quote from the Icelandic President? It’s only two posts down.

He’s right: bail out the people and jail the bankers.

I Gotta Cut Down on the Coffee

I was at work, and I was looking at a hinged plastic (Pelican type) case with some custom padding in it.

We are putting custom padding in the case so that we can ship equipment to the customer. (No more details)

I was trying to figure out why it was harder to closer than the earlier ones did, so I was loading the equipment , and then trying to load it without the equipment.

Eventually, I determined that there was not something interfering with the equipment, which might crush some delicate electronics, but that the hinge was a bit different, but that’s not a problem, because it does not clamp the equipment any more tightly.

I was using a sheet of paper as a sort of a feeler gauge in order to figure out where the interference was, and a co-worker walked up behind me and said something to the effect of, “Everything OK with the case?”

I yelped loudly, and jumped about 6 inches in the air, which stunned the hell out of both of us, and then we both started laughing, as I said, “Too much coffee.”

I think I might have been hyper-focusing a bit,

It’s Jobless Thursday?

Initial claims fell by 23,000 to 393,000.

We are still getting too much noise from hurricane/superstorm Sandy, I think that maybe by the 2nd week of December we will be getting good data.

Deep Thought

H/t DC at the Stellar Parthenon BBS.

Holy Sh%$, We Are Running out of Gullible Idiots

I understand that all resources are finite, but I never thought that it would apply to human gullibility and stupidity, indicating a continuing fall in trading volume.

I understand that all resources are finite, but I never thought that it would apply to human gullibility and stupidity, indicating a continuing fall in trading volume.

His explanation is that we are finally running out of rubes willing to trust Wall Street:

The uptrend bit is easy: volumes, at least until 2009, always went up over time, especially when they were helped along by things like decimalization and high-frequency trading. But what explains the downtrend? It’s not the decreasing number of stocks: that might explain a bit of what’s going on in the US, but it wouldn’t explain the rest of the world.

Instead, I think that what we’re seeing is the slow death of the stock-market investor — the kind of person who subscribes to Barron’s, idolizes Warren Buffett, and thinks of stock-market investing as a do-it-yourself enterprise. During the dot-com bubble, lots of people thought they were really smart when it came to stock-market investing, and then after the dot-com bubble burst, the rise of discount brokerages helped encourage new people to step in to the market and try their luck.

Nowadays, however, the message is sinking in: it’s a rigged game, you can’t win, and you’re better off with a passive strategy.

It is very hard for me to believe, but the idea that Wall Street is finally running out of hard-working, regular folks who are willing to be cheated is not an unreasonable thesis given this data.

Telco Breakup Has Hit the Mainstream

Because it’s hit the New York Times:

Since 1974, when the Justice Department sued to break up the Ma Bell phone monopoly, Americans have been told that competition in telecommunications would produce innovation, better service and lower prices.

What we’ve witnessed instead is low-quality service and prices that are higher than a truly competitive market would bring.

After a brief fling with competition, ownership has reconcentrated into a stodgy duopoly of Bell Twins — AT&T and Verizon. Now, thanks to new government rules, each in effect has become the leader of its own cartel.

The AT&T-DirectTV and Verizon-Bright House-Cox-Comcast-TimeWarner behemoths market what are known as “quad plays”: the phone companies sell mobile services jointly with the “triple play” of Internet, telephone and television connections, which are often provided by supposedly competing cable and satellite companies. And because AT&T’s and Verizon’s own land-based services operate mostly in discrete geographic markets, each cartel rules its domain as a near monopoly.

The result of having such sweeping control of the communications terrain, naturally, is that there is little incentive for either player to lower prices, make improvements to service or significantly invest in new technologies and infrastructure. And that, in turn, leaves American consumers with a major disadvantage compared with their counterparts in the rest of the world.

On average, for instance, a triple-play package that bundles Internet, telephone and television sells for $160 a month with taxes. In France the equivalent costs just $38. For that low price the French also get long distance to 70 foreign countries, not merely one; worldwide television, not just domestic; and an Internet that’s 20 times faster uploading data and 10 times faster downloading it.

It’s not from their editorial board, it’s from former Times correspondent David Cay Johnston, whose beat is consumer protection and tax loopholes, but the fact that anyone gets space in the “Gray Lady” to suggest that deregulation will not create a telecommunications utopia is worth noting.

Irony, You’re Soaking in It!

So, some neighborhoods in New York were set up as completely private. Their streets were private, and everything was behind fences.

Well, after hurricane Sandy, they are asking for a bailout:

Sea Gate looks the same as many storm-scattered waterfront communities do. Home after home torn apart by the ocean. Streets filled with sand. Shattered sidewalks and clogged sewers. A sea wall, which had already been inadequate to the task of safeguarding residents, reduced to rubble.

Ordinarily, New York City or other governmental entities might take over the tasks of restoring a middle-class neighborhood like this. But Sea Gate, with its 850 homes on Coney Island’s western tip, is not an ordinary neighborhood. It is a 113-year-old private, gated community, where the razor-wire-topped fences and armed security checkpoints that keep outsiders from its streets, beaches and parks serve as a constant reminder that the residents of this community have chosen to live somewhat apart.

Once the gilded retreat of the Vanderbilt family, Sea Gate, like other gated communities in New York, preserved its exclusivity with the promise that the residents would assume the costs of community upkeep, maintaining their own streets, parks and sewer systems and even fielding the distinct Sea Gate Police Department.

The special status endured, through occasional controversy and political efforts to open the streets to the public, because of the community’s self-sufficiency.

But the damage inflicted by Hurricane Sandy to Sea Gate, in Brooklyn, and another gated community, Breezy Point, in Queens, was so monumental that residents who are already struggling to figure out how they will pay to rebuild their homes say they cannot afford to pay the additional cost of repairing communal infrastructure. So neighborhoods that have long held the rest of the city at arm’s length now seek the financial embrace of the city, state and federal governments.

This is not public infrastructure, it’s private infrastructure.

They don’t have streets, they have a communal driveway. If they wanted it protected, they should have had insurance.

If they want public help for their private property, then the public needs PUBLIC access to those streets.

The city has already bulldozed sand off the streets and vacuumed sand out of the storm drains, and until their public spaces are once again public, that should be it.

H/t JR at the Stellar Parthenon BBS.

Who Says that Irony is Dead?

Donald Trump is suggesting that Republicans need to be more appealing to minorities.

Jeebus. Guy did everything but use the “N-word” to describe Barack Obama.

Because No One in Washington Believes In Public Works for the Public Good

Duncan Black wonders why Obama’s infrastructure plans have so much added complexity in order to accommodate private investors:

Duncan Black wonders why Obama’s infrastructure plans have so much added complexity in order to accommodate private investors:

I like me some infrastructure spending. I do not know why the government, which can borrow money for free, needs a rube goldberg machine with added middlemen to make it happen.

This one is simple: There is a Washington consensus about public projects these days, it’s that giving some rich dude the opportunity to earn a profit at taxpayer expense, is essential because of capitalism.

What are you a commie pinko or something?

Yes, the free market mousketeers are basically corrupt ratf%$#s.

BTW, that is one seriously fat cat.

Your Morment of Eric Arthur Blair*

Barack Obama, who has prosecuted more whistle blowers under the espionage act than all the Presidents combined, just signed the whistleblower protection act:

The Government Accountability Project (GAP) is praising President Obama’s signing of S. 743, the Whistleblower Protection Enhancement Act (WPEA), into law earlier today. The legislation provides millions of federal workers with the rights they need to report government corruption and wrongdoing safely. The bill reflects an unequivocal bipartisan consensus, having received the vote of every member in the 112th Congress, passing both the Senate and House of Representatives by unanimous consent over the past couple of months. The text of the bill can be read here.

It’s like something out of The Onion.

*You know, George Orwell.

No, I Was Not Arrested Today

Yes, I know that there was a a naked protest at John Boehners office today, against cuts in AIDS funding, but I was not involved in this.

If I had been there, and got naked, and had my hairy ass hauled into jail, the newspaper stories would have included the phrase, “A protester in a Wookie costume.”

That is all.

My God, Actual Regulation!

The Commodity Futures Trading Commission has effectively shut down Intrade, the online gambling house futures trading exchange, for US investors:

Facing accusations that it allowed American investors to bet on the outcome of wars and other world events without the blessing of regulators, Intrade announced on Monday that it was closing its Web site to United States residents.

The disclosure, which referred to “legal and regulatory pressures,” was released hours after American authorities sued the company, which is based in Dublin, over its popular trading network. Investors log on to Intrade by the thousands to bet on the outcomes of elections, the weather and even whether the United States will bomb Iran.

But in a civil complaint filed in federal court in Washington, the Commodity Futures Trading Commission took aim at the company and an affiliate for offering the contracts outside traditional exchanges and without regulatory approval. The agency also accused the companies of “making false statements” to regulators and violating a past order barring it from offering so-called prediction contracts outside traditional exchanges.

“Unfortunately this means that all U.S. residents must begin the process of closing down their Intrade accounts,” the company said on its Web site. “We understand this announcement may come as a surprise and a disappointment, and we apologize for the short notice and haste required to deal with this.”

I’m stunned.

I’m pleased, but I am stunned.

It’s a refutation of the philosophy of the “free-market mousketeers” who are inclined to allow all kinds of crazy sh%$ to pretend to be high finance, as opposed to a particularly abusive casino, in which the house takes even more than Vegas.

BTW, Intrade’s record sucked too, witness the gyrations in the 2008 Democratic and 2012 Republican primary markets.

No.

Will President Obama Restore the Rule of Law During His Second Term?

This has been another episode of simple answers simple questions.